CAR-T Week: Lyell IPO + Mnemo Therapeutics Raises + Much more weekly news

IPO. Fund raising. ZUMO-3. Other Phase 2 Clinical trials

This week, I kept my focus on cancer Therapy, especially on CAR-T Therapy.

A strong CAR-T company IPOed last week Friday. Lyell Immunopharma is attacking the solid tumor treatment market. The market is expected to reach $424.6 billion by 2027, expanding at a CAGR of 15.0% from 2019 to 2027.

I also covered further news related to CAR-T therapies.

Lyell IPO: S-1 Briefing

Preclinical solid tumor biotech Lyell Immunopharma raised $425 million to work on new cell therapies for cancer. The South San Francisco-based company offered 25 million shares priced at $17.

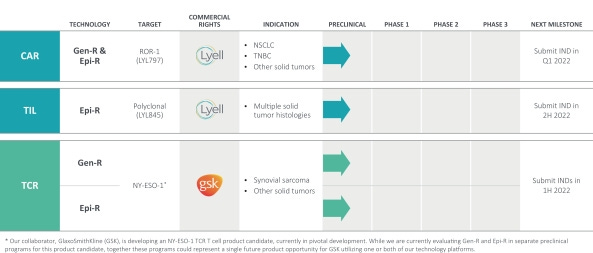

Lyell views two major barriers to successful autologous cell therapy as T cell 1) exhaustion and 2) lack of durable stemness. Gen-R and Epi-R are set to overcome the two barriers by their proprietary epigenetic and genetic reprogramming technology platforms.

These technology platforms are designed to be applied in a target and modality agnostic manner to CAR, tumor-infiltrating lymphocytes (TIL), and T cell receptor (TCR) therapies to fundamentally improve the properties of T cells needed to eradicate solid tumors.

The company believes that both technologies will help bring T cell therapies to solid tumors. As of now, the FDA-approved CAR T cell therapies address only blood cancers. Lyell said it believes its T cell reprogramming platforms can be directed at any type of cancer in the filing.

The lead Lyell program, LYL797, is a CAR-T therapy being developed to target ROR1, a protein overexpressed in some cancers. The company is developing this therapy as a treatment for non-small cell lung cancer and triple-negative breast cancer. Lyell expects to file an investigational new drug (IND) application for that program in the first quarter of 2022.

The next program, LYL 845, is a type of cancer immunotherapy called a tumor-infiltrating leukocyte. Lyell is developing this cell therapy for multiple types of solid tumors. LYL845 incorporates the company’s Epi-R technology to improve the durable stemness of the cells that comprise the therapy. Lyell expects to submit an IND filing in multiple tumor indications in the second half of next year.

Their collaboration with GSK is developing a NY-ESO-1 TCR T cell product candidate. NY-ESO-1C239, currently in pivotal development. Preclinical efforts and IND-enabling studies are underway. They anticipate GSK will conduct initial clinical trials with an enhanced product candidate in synovial sarcoma and multiple other solid tumor indications (first half of 2022).

Gen-R and Epi-R Technology Platforms:

Gen-R

T cell exhaustion results from transcriptional and epigenetic changes that occur as T cells differentiate into a dysfunctional state. A strategy to prevent T cells from becoming exhausted would be ideal for improving the effectiveness of ACT against solid tumors.

Lyell discovered a state called chronic antigen stimulation, essentially when a T cell is always in an “on” state. An immunosuppressive solid tumor microenvironment combined with an immunosuppressive solid tumor TME likely promotes T cell exhaustion.

Their researchers showed that Gen-R could overcome T cell exhaustion/reinvigorate the T cells and restore the antitumor activity by expressing a protein called c-JUN. This data has been shown in preclinical (animal) models in solid tumors.

c-JUN combines with another protein, FOS, to form an AP1 protein complex. This protein complex collaborates with NFAT to direct the transcription of genes required for T cell effector function.

Overexpression of c-JUN in CAR-T cells restores their antitumor activity in preclinical solid tumor models. The same CAR-T cells do not overexpress c-JUN exhaust and fail to eliminate the tumor.

Epi-R

Lyell has also developed another ex vivo epigenetic reprogramming technology for creating T cells with durable stemness. They define stemness as the “ability of T cells to maintain their stemness until the tumor is eradicated; that is, they have the ability to self-renew despite continued persistent signals from the tumor driving activation, proliferation, and differentiation.”

The resulting Epi-R T cell populations have in vitro and preclinical in vivo properties, suggesting that they are significantly more potent than those generated by standard approaches to manufacturing T cells for ACT.

Lyell’s Epi-R has been designed to generate populations of T cells that have durable stemness, and “relating specifically to TIL, application of Epi-R has generated T cell preparations that exhibit increased polyclonality, i.e., the retention of a broad repertoire of TCR clonotypes.”

🧫 Other News This Week

CAR-T Therapy

Harbour BioMed and Dana-Farber Cancer Institute agreed on a research collaboration deal to co-develop various novel cancer biotherapies, including CAR-T cell therapy. The collab comes a month after Dana Farber announced a multi-year $2 billion fundraising campaign to accelerate its cancer research. Dana-Farber has been committed to providing adults and children with cancer with the best treatment available today while developing tomorrow's cures through cutting-edge research,

Harbour BioMed discovery and development programs are built around its two patented transgenic mouse platforms (Harbour Mice) for human antibody discovery. The mouse platform is used for the development of CAR-T based therapeutic solutions. The Dana Farber collaboration is Harbour BioMed’s effort to leverage their transgenic mouse platforms for generating fully human antibodies to enable and enhance CAR-T therapies.

Harbour already showed its capability to commercialize its research. They discovered the antibody 47D11 in 2019, which AbbVie has since licensed out. In December 2020, the company’s scientists said that the antibody showed promise fighting Covid-19 and variants of the virus.

Mnemo Therapeutics SAS emerged from stealth mode, having raised €75 million (US$91 million) in a Series A financing round to take forward a new CAR-T platform, which is focused on selectively targeting both solid and liquid tumors. Focuses on the previously undescribed class of antigens and on improving the persistence of CAR-T cells.

Mnemo is targeting the antigens that are difficult to crystallize, especially in solid tumors. Tumor antigen specificity is a big challenge in CAR-T therapy. And in solid tumors, some antigens are overexpressed but at lower levels elsewhere, making the targeting via CAR-T difficult. They aim to identify epigenetic antigens as targets for CAR-T treatments. Epigenetic antigens result from DNA sequences called transposable elements that can change their position within the genome and create mutations. This leads to the production of proteins that are found in the tumor cells but not healthy cells.

I believe Mnemo with a start rising again soon. Once the preclinical data is collected, a new Series will be announced (hopefully!)

CBMG Holdings is developing innovative cellular immunotherapies for the treatment of cancer. They announced updated clinical data for their drug: C-CAR039. A novel CD19/CD20 bi-specific CAR-T cell product in relapsed or refractory B-cell non-Hodgkin lymphoma.

C-CAR039 has been developed as a CAR-T targeting both CD19 and CD20 antigens with an optimized bi-specific antigen binding domain.

34 patients were infused with C-CAR039. Among them, 28 patients had more than 1-month of safety data, and 27 were evaluable for efficacy. 92.9% (26/28) of patients experienced CRS. 25 of 26 were in grade 1 or 2. Only 1 patient experienced grade 3 CRS. The complete response (CR) rate was 85.2% (23/25).

The Company plans to submit an IND to the US FDA later this year and initiate a Phase 1b study in the first half of 2022 based on communication with FDA.

Results from the Phase II ZUMA-3 study for Gilead’s Tecartus (KTE-X19) were presented. Adult patients with relapsed or refractory acute lymphocytic leukemia (ALL) received a Tecartus infusion.

Novartis’ CAR-T cell product, Kymriah, is primarily aimed at pediatric R/R patients, with its label specifying use in patients up to 25 years of age, but is sometimes used off-label in young adults patients older than 25. Older adults, therefore, have no access to a CAR-T cell product that could offer long-term remission with a single treatment instead of a stem cell transplant.

In ZUMA-3, out of 55 evaluable patients, 70.9% presented with a CR/CRi, meeting the primary endpoint. CRS of any grade was observed in 89% of patients. Tecartus was successfully manufactured for 92% of patients, which is on par with other CAR-T cell products.

Tecartus could be available in the US market in the fourth quarter of this year, given its breakthrough therapy and orphan drug designations.

Umoja Biopharma is ramping up with$210 million in fresh Series B funds seven months after its launch.

While most current therapies in development take the patient's own T Cells out of the body, Umoja reprograms immune cells in vivo, tremendously lowering cost and common side effects while increasing accessibility.

The Series B funding will be used in part to advance Umoja’s two lead programs into the clinic: TumorTag UB-TT170 for folate receptor-expressing solid tumors and VivoVec UB-VV100 for CD19+ hematological cancers. Both in vivo engineered CAR T cell immunotherapies.

Antibody Therapy/Drug

Iksuda Therapeutics, a British company, has raised $47 million to take a CD19-targeted antibody-drug conjugate (ADC) into the clinic.

ADCs are a class of biopharmaceutical drugs designed as a targeted therapy for treating cancer. Unlike chemotherapy, ADCs are intended to target and kill tumor cells while sparing healthy cells. Antibodies attach themselves to the antigens on the surface of cancerous cells. Once the ADC is internalized, the cytotoxin kills cancer.

Their CD19 prospect IKS03 uses a prodrug payload technology created to enable the cancer-selective activation of the cytotoxic agent. Again, the goal is to prevent the payload from harming healthy cells.

Iksuda will use the money to take IKS01 into the clinic as a treatment for B-cell cancers. ADC Therapeutics, a swiss company, listed on NYSE, won FDA approval for its CD19-targeted ADC in April 2020. Iksuda is taking the competition on.

Checkpoint Inhibitor (Cancer Treatment)

Kahr has raised $46.5 million to move a CD47x4-1BB targeting fusion protein deeper into the clinic. Kahr developed a drug, DSP107, which is designed to simultaneously block an immunosuppressive signal and activate T cells by binding to CD47 and 4-1BB. DSP107 is now in a phase 1/2 clinical trial that is testing it as a single agent and in combination with Roche’s Tecentriq in patients with advanced solid tumors.

Kahr sees particular potential for cell lung cancer. They also plan to start a phase 1/2 clinical trial in acute myeloid leukemia, myelodysplastic syndrome, and T-cell lymphoproliferative diseases in the coming months.

CD47, a 'marker-of-self' protein overexpressed broadly across tumor types, is emerging as a novel potent macrophage immune checkpoint for cancer immunotherapy.

HCW Biologics files for IPO. HCW Biologics is a clinical-stage Florida-based biotech that develops fusion protein therapies that modulate inflammation to treat cancer and other age-related diseases. Last week, the company announced it was seeking to raise $50M in an IPO listing on the NASDAQ.

HCW Biologic’s HCW9218 is designed to block transforming growth factor-ß (TGF-ß), which is believed to have immunosuppressive and pro-cellular senescence activity. Initial indications for HCW9218 are cancer (to remove chemotherapy-induced senescent cells) and idiopathic pulmonary fibrosis (IPF).Inflammation and immune system dysregulation has been linked to aging (“inflammaging”), and several companies are developing anti-aging therapeutics in these contexts. Longevity startups like Rejuversen and Oncosence target the connection between senescent cells, SASP, cancer, and chemotherapy.

Alpine Immune Sciences reports 61% 'clinical benefit' in an early trial of CD28-targeted immuno-oncology drug. Their first-in-class lupus drug that inhibits a protein on the immune system’s T cells called CD28 has early evidence its plan may be working.

Alpine presented initial data from an ongoing phase 1 trial of its immuno-oncology candidate ALPN-202, a CD28 costimulator, during the American Society of Clinical Oncology (ASCO) virtual annual meeting. 61% of the 23 patients who were evaluated derived some clinical benefit, which the company defined as stable disease or better, Alpine said.

Targeting CD28 has proven challenging, however, because of safety concerns. Some patients in early clinical trials suffered severe inflammatory reaction cytokine release syndrome.

Animal Biotech

Greenfield, Indiana-based Elanco Animal Health will buy Kindred Biosciences for approximately $440 million to boost its pipeline in the pet health market. KindredBio gives Elanco three potential blockbusters in dermatology expected to come to market through 2025, which is slated to provide Elanco an additional $100 million in innovation revenue by that year.

Elanco had already snagged the global commercial rights to KindredBio's late-stage treatment for parvovirus. The treatment, called KIND-030, demonstrated 100% survival in dogs infected by parvovirus versus a 43% survival rate for dogs treated with a placebo. The company expects possible approval from the USDA by year-end.

The news sent Kindred shares up 45% in premarket trade. "Kindred Biosciences' monoclonal antibody pipeline and capabilities are additive and complementary to what we've built within Elanco," said Aaron Schacht, executive vice president of Innovation at Elanco.

USDA is moving ahead with making sweeping reforms to how biotech animals are regulated, according to the first regulatory agenda issued by the Biden administration.

The agenda says the regulatory framework that USDA is considering would put the Animal and Plant Health Inspection Service in charge of assessing whether biotech animals would be susceptible to pests or diseases or have the ability to transmit them. USDA’s Food Safety and Inspection Service would conduct a pre-slaughter food safety assessment to ensure that the meat would be safe.Loyal announces partnership with Morris Hospital to study aging in golden retrievers. Loyal is a startup founded by Celine Halioua, developing anti-aging drugs to extend lifespan first in dogs. The company recently announced a partnership with Morris Hospital to do a lifespan/cancer aging study in golden retrievers -- a breed known for its propensity to cancer. Loyal will measure DNA methylation in blood samples collected over nine years of the life of the retrievers in the study. Loyal isconducting their own shorter multi-breed dog healthspan study in collaboration with multiple veterinarian clinics in the United States.

Thanks for reading BiotechVibe. If you enjoy this newsletter, please share it with a friend or colleague. You can reach me on Twitter